Your customs solutions

Present at the main sea and air ports in France, our teams will work with you in the planning stages to optimize your customs strategies for import/ export, and beyond.

- Release of products for consumption (clearance through customs and import with payment of duties and taxes);

- Verification of documents that prove certifications required for import/export (laboratory tests, CE, ROHS, EU, etc.);

- Bonded warehouses: importing warehoused merchandise to allow payment of duties and taxes as they leave the warehouse;

- Secured bonded shipment(T1 and T2);

- Inward or outward processing (processing under customs control for import or export).

- Temporary admissions (with partial or total exemption of customs duties or VAT);

- ATA carnets (temporary import or export of products with suspended duties and taxes) ;

- Analysis of needs, origins, and value in customs. Tariff classification (RTC) of your merchandise.

Our group also offers, via MATHEZ COMPLIANCE, a specialist in VAT solutions and services,regulatory assistance and VAT & customs training (MATHEZ FORMATION) taking care of your declarative obligations EMEBI (ex-DEB), DES, Intrastat (MATHEZ INTRACOM, 1st third party declarant in France), and solutions of VAT fiscal representation (EASYTAX).

Freight / Customs Quote

Brexit / Customs clearance

We offer logistics, customs and VAT solutions to companies and freight forwarders for their flows between the United Kingdom and the European Union via France. We're not a trucking company.

- We handle: customs clearance for full trucks, recurrent shipments, general freight.

- Do not ask us for: import groupage, spotrequests, removals and personal effects, perishable goods, plants or live animals, alcohols, products requiring veterinary inspection.

Effective management means the power to anticipate! We work on the front end so that your customs clearance will simply be a perfectly smooth formality.

Your Guarantees & Benefits

AEO-Full Certification

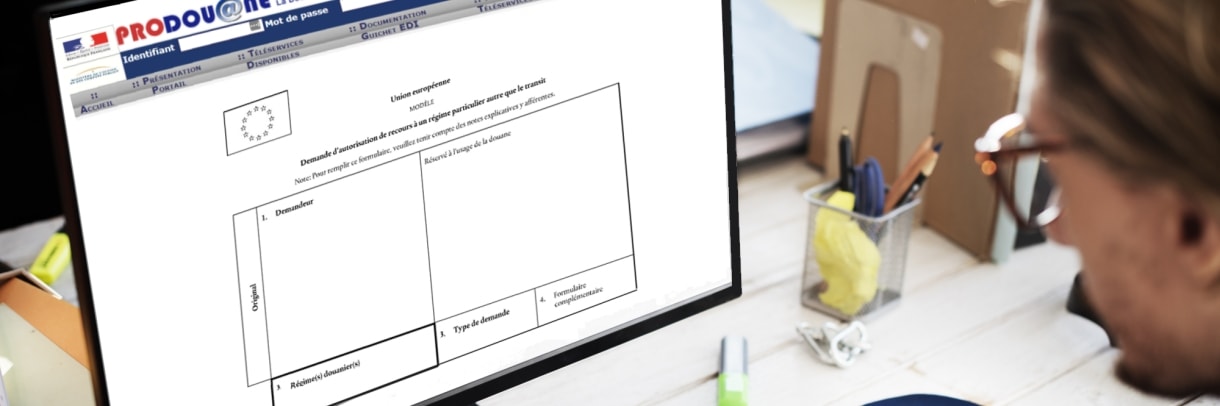

Paperless customs clearance

Our expertise

Customs Regulatory Assistance

VAT Solutions

Your questions regarding customs procedures

- 1

What is the difference between a licensed customs broker and a Registered Customs Representative (RCR)?

In 2016, in the European Union Customs Code, the Registered Customs Representative (RCR) status replaced the Customs broker licence. Nevertheless, in everyday language, people often use the term "Customs broker".

Traditionally in France, it has been the Customs Administration that granted the Customs broker authorization. This authorization allowed brokers to perform customs formalities in all the sea and air ports in France, for both imports and exports, using various representation methods (direct or indirect), and all customs policies (permanent or temporary).

In May 2016, the European Union adopted the European Union Customs Code, which standardized customs legislation throughout Europe. It sets the contours of the "Registered Customs Broker" (RCR) article 18 statute. While both representation methods (direct and indirect) are maintained, direct representation is no longer reserved exclusively for customs brokers. Rather, it is open to all certified operators who have the AEO status (Authorized Economic Operators) who are able to act as customs brokers in the member states other than those in which they are established.

In France, customs brokers must be registered in advance and they have to fulfill certain conditions including customs expertise criteria (starting on January 1, 2018).

> Find out more about the Registered Customs Broker on the French Customswebsite.Licensed Customs Broker since 1951, MATHEZ FREIGHT has been an Authorized Economic Operator since 2013 and a Registered Customs Representative since 2016.

- 2

Why is it best to choose a certifed AEO-Full customs broker?

The "AEO" accreditation (Authorized Economic Operator) is granted by the Customs Administration to companies that meet strict customs criteria and demonstrate consistent quality, compliance and reliability in the international supply chain.

> More info on the French Customswebsite.Working with a " AEO - Full" freight forwarder gives you, as a shipper, the following advantages:

- Fluidification of your customs operations,

- Reduced and optimized physical and documentary controls for your goods,

- Recognised status in the European Union as a whole and in the world as a whole.

The "AEO-Full" approval will be very much appreciated by your foreign customers or buyers.

Since 2013, MATHEZ FREIGHT benefits from the AEO-Full status, which includes the AEO "customs simplification" certificate and the AEO "security-safety" certificate. When you work with MATHEZ FREIGHT, you can be assured that all your customs operations throughout the EU and beyond will be carried out accurately, reliably and professionally, to the highest standards.

- 3

When should you review the customs regulations for a product?

As soon as you anticipate shipment of a product, it is essential to verify the applicable rights and taxes, as well as associated regulation in order to fully appreciate customs risks and optimize your operations in terms of fiscal and customs requirements.

In the event of any doubt, request a product customs classification (Binding Tariff Information).

"All about the Binding Tariff Information with MATHEZ FORMATION. - 4

Why should you centralize your customs clearance procedures with a single customs broker?

Many companies commit the mistake of using several Customs brokers either because they export EXW and allow the buyer at their destination to chose the freight forwarder or because they are looking for the lowest bidder on a case by case basis. The practice in Europe is that the party which transports the merchandise also clears it through customs: these companies in the end rely on numerous sub-contractors transmitting their customs paperwork. A multiplicity of customs brokers will lead to inconsistencies and complicates retrieval of customs documents and particularly the outward ECSwhich is mandatory to prove export invoicing with tax not included.

On the contrary, working with a single point of contact will facilitate exchanges and retrieval of your customs documents. Centralization will also allow you to entrust your customs formalities to a close-knit team who knows your origins, your terms, your procedures, and who can help:

- Ensure compliance with formal requirements in consideration of the extension of customs limitation periods (6 ans).

- Reduce the costs of your customs clearance operations.

- Optimize your customs operations, thanks to a more effective mappingof your flows.

- 5

How do you optimize your customs formalities?

The response will depend a lot on your organization. Possible areas for improvement:

- Business optimization: if you pay for shipping, optimize your customs procedures. At a minimum, use incoterms that will help you handle your customs formalities: DAP (Import) and FCA (export). Eliminate the EXW for exports and the DDP for imports.

- Logistics optimization: by becoming an Authorized Economic Operator (AEO).

- Tax optimization: by putting a bonded warehouse in place at your site. Even a small space can be a certified bonded warehouse.

- Secure your customs information by creating a database for cross-referencing your product details and your customs classifications.

Contact us! We are available to advise and assist you throughout each of these procedures.

- 6

What are the risks associated with an export sale under the EXW incoterm?

If for you EXW incoterm (ex-works) seems very advantageous for export, committing you to little in terms of liability and fees, from a customs point of view, there is still just as much risk.

For EXW sales, the exporter's invoice does not include Tax, and it appears in box 2 of the Single Administrative Document, without addressing export customs formalities or the choice of the customs broker. You are leaving yourself open to risks:

- It is difficult to retrieve your Single Administrative Documenton the "way out" or even to get alternative proof of exit from the European Union Customs Territory, and the result would be a rejection of the invoice that does not include taxes in the event of an audit.

- You are not in full control of the data included on the Single Administrative Document (terms, value, origin) which may be incorrect and not under your oversight (customs dispute).

- And most importantly, you are not managing shipping. You are allowing your client to decide the shipping agent you're going to use, when that company will come, who is going to handle your customs obligations and archive your declarations.... and also, you are depriving yourself of a part of your revenue because generally speaking our clients apply a margin on our shipping price for their "management fees".