Quick Tips for Logistics Professionals

Every year, the Combined Nomenclature defining customs codes and tariffs for the European Union changes, particularly in January and July.

- The main changes to the European customs tariff on January 1, 2026 concern batteries and energy storage, renewable energies (wind, hydro, solar, hydrogen), as well as advanced materials and components. The revision of Annex 10 concerns certain mixtures of halogenated ethylene and propylene derivatives.

To check the customs tariffs for your products and the changes in January 2026:

- Download the European customs tariff 2026 (PDF, 22/9/2025 effective as of 1/1/2026, EUR-LEX) and identify changes (★ or ■).

- Consult the TARIC databasedatabase, check the European TARIC/10 nomenclature nomenclature (XLS, 12/31/2025 FR / EN, source CIRCABC) or use the customs code correlation table 2025-2026 published by the EU (XLS, 8/1/2026, source CIRCABC).

- Check daily updates on the French service RITA News bubble – Nomenclature changes.

What is the European customs tariff?

To clear all goods crossing international borders, Customs, customs declarants and freight forwarders use customs codes, called HS codes ( Harmonized System) codes, or commodity codes codes.

> See our article: Import and export customs codes.

In the European Union (EU), these codes are defined in the Combined Nomenclature (CN), which organizes goods without the Common Customs Tariff that applies when entering the European Union. Every year, the 8-digit Combined Nomenclature evolves to keep pace with the reality of international trade. A major update is made in January, followed by others, notably in June/July.

Changes to European nomenclatures on January 1, 2026

The edition of the European customs nomenclature 2026dated September 22, 2025, came into force on January 1, 2026 with implementing regulation (EU) 2025/1926.

27 new codes are introduced, while approximately 13 old codes become invalid.

Here is an overview of the main chapters and products affected:

Chapter 28 – Inorganic chemicals

★ Creation of specific CN subheadings for advanced compounds used in batteries, including: lithium-nickel-manganese-cobalt oxides (NMC), lithium-iron phosphate (LFP). Products previously classified under “other” headings.

→ Families concerned: 28.25 / 28.26 and 28.34 / 28.36.

Chapter 29 – Organic chemicals

★ Reorganization of several subheadings in line with WCO recommendations: new codes for certain aromatic ethers, adjustments for saturated acyclic monocarboxylic acids and their derivatives, with a view to improving readability and chemical precision.

→ Families concerned: 29.09, 29.15

Chapter 38 – Miscellaneous chemical products

★ Introduction of new subheadings for products related to clean technologies / environmentally related technologies: artificial graphite, photovoltaic wafers for the manufacture of solar panels.

→ Families concerned: 38.01, 38.24.

Chapter 73 – Articles of iron or steel

★ Creation of codes dedicated to structures for renewable energies: tubular steel towers for wind turbines, wind turbine tower sections.

→ Families concerned: 73.08.

Chapter 84 – Machinery and mechanical appliances

★ New subheadings for power generation equipment: rotors and stators of hydraulic turbines, blades of wind turbines. → Finer distinction between conventional industrial machines and energy equipment.

→ Families concerned: 84.10, 84.12 / 84.13.

Chapter 85 – Electrical machinery and equipment

★ Adaptation to advanced electrical and energy technologies: hydrogen fuel cell generators, inverters incorporating maximum power point tracking (MPPT), plastic separator films for batteries, modules made up of stacked galvanic cells.

→ Families concerned: 85.01, 85.04, 85.07.

Chapter 95 – Toys, games and sports requisites; parts and accessories thereof

■ Deletion of Additional Note 1 relating to Christmas party items. → Simplification and harmonization of classification rules.

→ Family concerned: 95.05.

★ Refers to new code numbers

■ Refers to code numbers that were used in the previous year, but with a different content.

These changes are designed to better reflect technological developments, strengthen the control of sensitive goods, and improve the statistical accuracy of trade flows.

More information on customs codes and tariffs

- How to check your customs codes and tariffs in 2026?

- Check for changes in EU tariffs in 2020, 2021, 2022, 2023, 2024, 2023, 2025.

- Customs codes: what you need to know when trading with the EU

How do you check your customs codes in 2026?

RITA – French customs nomenclature

EUR-Lex – Combined Nomenclature

TARIC – EU Customs Tariff

HS Tracker (WTO/WCO)

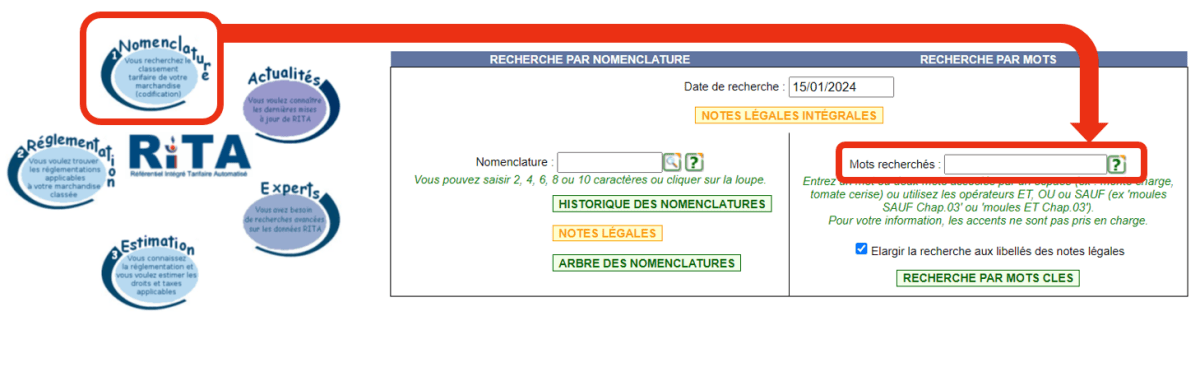

RITA: check the customs code of your goods and follow the latest news

The RITA (Référentiel Intégré du Tarif Automatisé) is the reference catalog of the EU and French customs tariffs and is constantly updated by the French Customs. It brings together regulations concerning the tariff classification of goods, applicable duties and taxes, required accompanying documents, etc.

The RITA encyclopedia offers you a dematerialized version of the customs tariff, with search ergonomics infinitely superior to those of the official text available on EUR-lex!- Use RITA to determine your customs codes by going to douane.gouv.fr, RITA Encyclopedia.

- Check for changes during the year on RITA > bulle Actualités – Modifications de nomenclatures. Please note that these news are only available temporarily.

- Use RITA to determine your customs codes by going to douane.gouv.fr, RITA Encyclopedia.

Eur-Lex: download the European customs tariff 2025 and check for changes

Download the European Customs Tariff 2026 in PDF in English, French or the language language of your choice on the EUR-Lex website.

To identify changes, look for (ctrl + f) the signs ★ or ■ in the PDF version:

★ designates new customs code numbers;

■ designates code numbers that were used the previous year, but with a different content.TARIC: check correlations and consult the EU’s Integrated Tariff online

The European Commission maintains the TARIC database (Integrated Tariff of the European Union).

- To help you check whether the customs codes used by your company will change between 2023 and 2024, use the TARIC 2025/2026 correlation table (updated 10/1/2025, excel, source CIRCABC).

- Consult the TARIC Europa database online on the EC Europa website, updated daily, and watch for TARIC news on CIRCABC.

For the record:- The last 2 digits (10 and 80) indicated in the columns following the TARIC code are “indices” and are not part of the TARIC code itself.

- The codes followed by an index 10 are “intermediate” lines of the nomenclature, i.e. “subheadings” of descriptions. These positions followed by 10 are therefore not “reportable” TARIC codes.

- The codes followed by the index 80 are the TARIC codes “declarable” for customs clearance.

- See sheet 1 “TO READ” of the excel table for further explanation.

Use the HS code nomenclature of the World Customs Organization (WCO)

The HS codes were last revised worldwide in 2022. The revision cycle is normally every 5 years, but for this edition the cycle has been extended by one year, bringing the next edition to 2028. The next edition of 6-digit Customs Code (HS6) will come into force on January 1, 2028.

Use HS TRACKER from the World Trade Organization and the World Customs Organization to track the evolution of your HS codes from 1992 to today.

Changes envisaged by the WCO by 2028 (SH 2028)

The World Customs Organization (WCO) has initiated the revision of the Harmonized System 2028 (HS 2028), scheduled to come into force on January 1, 2028. The amendments have been adopted on a provisional basis and will be the subject of an official publication prior to their implementation.

Among the guidelines identified:

- Waste oils containing PCBs (2710.91): consideration of a more refined classification to improve monitoring of hazardous waste and compliance with the Basel Convention.

- Chemical Weapons Convention (CWC): recommendations for taking greater account of OPCW Schedules 1 and 2 substances to strengthen customs controls.

- Rotterdam Convention: possible adaptation of certain headings in Chapter 29 (notably 2903) to better identify restricted chemicals.

At this stage, these are the WCO’s technical recommendations and guidelines, whose definitive inclusion in HS 2028 will have to be confirmed when it is officially published.