Quick Tips for Logistics Professionals

- International after-sales returns involve several customs procedures (initial export, re-import, re-export after repair, final re-import).

- Three customs solutions for your after-sales returns:

- The Return System (RGR) customs procedure for returns is suitable for one-off flows, but requires precise documentation (serial numbers).

- It’s easy to release for consumption, but there are tax risks (non-deductible VAT).

- Inward processing is ideal for regular, complex flows (high value, high rights).

- Successful returns depend on the quality of customs documentation (invoices, serial numbers, reasons for return).

- Beware of flows managed by express carriers : give preference to a Registered Customs Representative (RDE).

Exporting industrial equipment under warranty brings with it complex customs challenges. Find out how to simplify your international after-sales returns and avoid the pitfalls.

Understanding the customs issues involved in international after-sales returns

You export industrial equipment under warranty: what happens when a product breaks down abroad? Over and above the logistical aspects, the return of goods for repair raises significant customs and tax issues: customs duties, VAT, documentation, special regimes, etc. Inadequate management can generate avoidable costs.

Here is an overview of the options for securing these international after-sales flows.

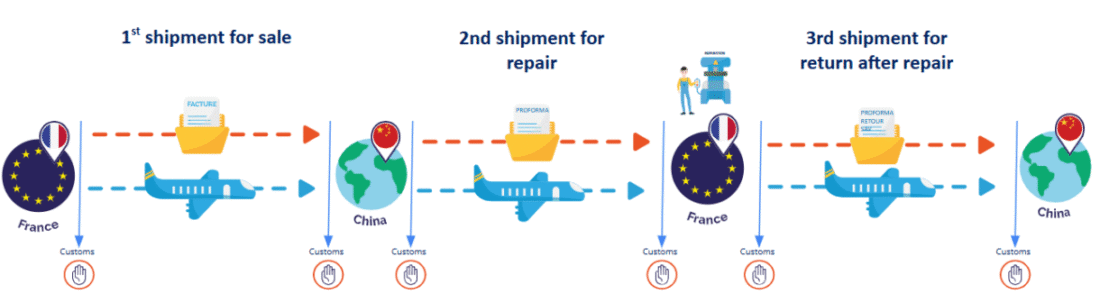

Let’s take a concrete case: you sell a 3D printer in China (HS code 8485.20.00.00, value €200,000 – €300,000), with a two-year contractual warranty. In the event of an after-sales return, you’ll have to manage an initial export (sale), a re-import into France (return), a re-export after repair, a re-import at destination.

Each customs clearance presents a potential challenge in terms of duties, VAT, traceability, or documentary compliance.

Rigorous organization is essential. This management is an integral part of reverse logistics “a key concept in optimizing international returns.

Three customs solutions for your after-sales returns

1> RGR (Returns System): simplicity with conditions

This scheme allows re-importation with total exemption from customs duties and VAT, provided that the following can be demonstrated:

- the goods are re-imported within three years,

- that they have not been modified,

- they are identifiable (serial number, marking, etc.),

- we can provide the initial export declaration and an invoice.

RGR is well suited toone-off after-sales flows , particularly when products are subject to customs duties. But be careful:

- The French Customs Authority (DGDDI) may refuse to apply the returns system if the serial number is not indicated on the documents,

- Express carriers rarely manage this system correctly: opt for a Registered Customs Representative (RDE).

2> Release for consumption: a deceptive facility

When goods are not subject to customs duties, many manufacturers or sellers are tempted to opt for the definitive release of returned products, without applying for any special arrangements.

This treatment offers a number of advantages:

- Simple customs formalities,

- Fast customs clearance, often handled by an express delivery company,

- Self-assessment of VAT on imports (but you have to understand its limits).

- No customs duties payable, if zero rate.

But this choice has several limitations and drawbacks:

- The release for consumption of repair-related shipments is considered a definitive act. As such, the importer cannot claim a refund of customs duties paid, even in the event of re-export, and the duties are definitively lost. Hence the importance of structuring your after-sales flows from the outset, to avoid impossible regularizations after the fact.

- VAT tax risk: Even if no customs duties are payable, import VAT is in principle due. However, according to tax doctrine (BOFiP BOI-ANNX-000210), this VAT is only deductible if the taxable person is the owner of the goods and uses them for his own taxable operations. As a repairer, you are generally not the owner of the goods: you therefore lose the right to deduct, and the VAT becomes a definitive charge.

3> Inward processing: the best customs regime for regular shipments

Inward processing is a special customs procedure which allows non-EU goods to be imported with total suspension of duties and VAT, with a view to their repair or processing before re-export.

It is particularly useful for :

- regular shipments,

- high-value products subject to customs duties,

- well-organized flows.

The system may seem technical, but with the right support, it becomes a robust and secure solution. It also avoids the VAT issues mentioned above.

- Audit of logistics and contractual flows

- Creating and enabling a customs account (TP/CDS)

- Setting up a material accounting system (clearance account)

- Follow-up of movements, compliance with deadlines, clearance management

Best practices for securing your international after-sales flows

Mastering customs documentation: the key to successful after-sales returns

The success of an after-sales return depends largely on the quality of your commercial and customs documents. Here are a few guidelines:- If the goods are not sold, use a Proforma invoice or a Customs Invoiceinvoice.

- Specify the reason (return under warranty, repair, etc.) and the estimated value for customs purposes.

- Always include serial numbers for easy identification.

Express shipments: beware of automatic declarations

Return flows managed by express carriers (DHL, UPS, FedEx…) are often cleared through customs for consumption, without any special instructions. Frequent consequences:- No special regime requested,

- Unjustified payment of VAT or duties,

- Loss of traceability.